Canada has long been known as the “Land of 10,000 Taxes,” so how much of our lives are taxes?

According to the Toronto Sun, a recent data exposure, many people may be shocked. According to the report, the average Canadian pays more in taxes than they spend on necessities.

Image Source: Sourced from the Internet

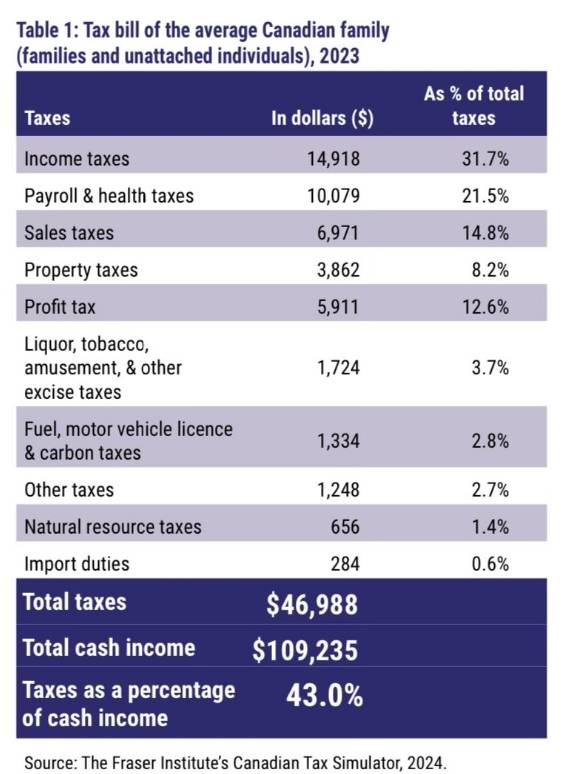

According to a new report from the Fraser Institute, last year, the average Canadian household spent more of their income on all forms of taxes (43%) than on basic necessities like food, shelter and clothing combined (35.6%).

For an average household (including families and unmarried individuals) with an income of $109,235, total taxes in 2023 would be $46,988, while total spending on housing ($23,809), food ($12,607) and clothing ($2,514) would be $38,930.

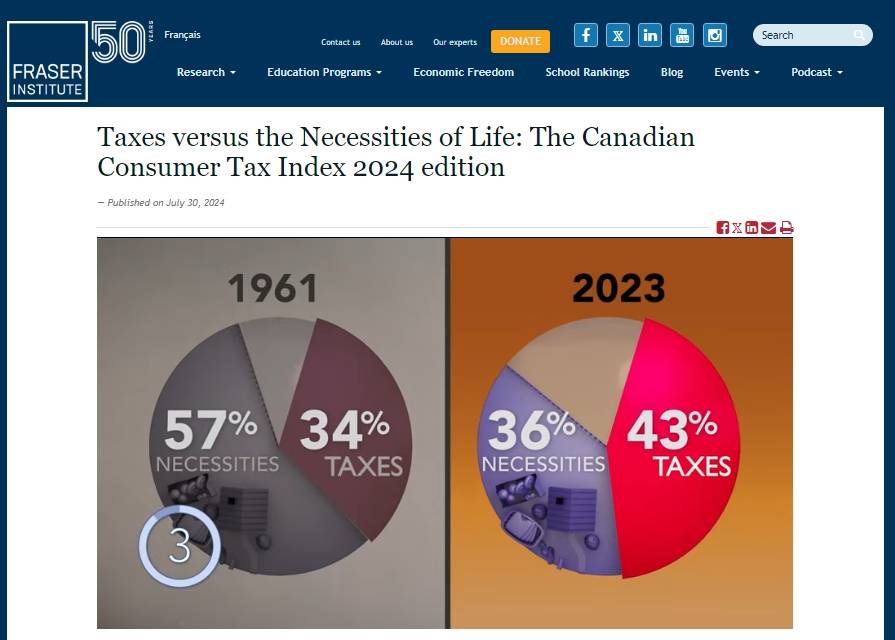

Since 1961, total taxes paid by Canadians have increased by 2,705%, faster than increases in income (2,085%), housing (2,006%), food (901%), clothing (478%) and the Consumer Price Index (901%), the study by the fiscally conservative think-tank shows.

If the total federal and provincial government deficits are considered to be deferred taxes, the study says, the total taxes faced by the average household in 2023 would be 2,852% higher than in 1961.

The study notes that while the average household in 1961 spent 56.5 percent of its income on food, housing and clothing and 33.5 percent on taxes, the situation has been reversed today, with households spending the largest share of their income: 43 percent on taxes rather than necessities (35.6 percent).

According to Taxes and Necessities: The 2024 Edition of the Canadian Consumer Tax Index, total taxes in 2023, adjusted for inflation, have increased by 180.3% since 1961.

The study defines total taxes paid by Canadians as the sum of these taxes, including but not limited to the following

Federal and provincial income taxes

Payroll taxes

Health taxes

Sales taxes

Land taxes,

Fuel and carbon taxes,

Vehicle taxes,

Natural resource taxes,

import taxes and alcohol and tobacco taxes

And the list goes on and on.

The Fraser Institute's annual study reminds us that the total amount of taxes paid by Canadians far exceeds income taxes, and that affordability is not just about the rising cost of living, as evidenced by inflation and the rising cost of housing, food and shelter.

It also has to do with how much after-tax income Canadians must have in order to pay for basic living expenses such as: a down payment on a house or condo or interest on a mortgage, or to rent an apartment, or to buy food, or to buy winter clothes for their children, or to pay for gasoline in the vehicles they need to stay afloat.

Image Source: Sourced from the Internet

Since the average family pays 43% of their income in taxes, it's not surprising that 46% of Canadians said they are moonlighters in a recent Leger poll.

In another annual report also released by the Fraser Institute on Tax Freedom Day, the average family spends the first five to six months of their yearly income (depending on the province in which they live) paying taxes, and only starts earning money for themselves from then on.

That said, taxes do go to pay for a wider range of public services today than they did in 1961, including health care, and are partially returned to Canadians in the form of welfare programs such as Employment Insurance EI, the Canada Pension Plan and Old Age Security.

Image Source: Sourced from the Internet

But critics of the Fraser Institute's calculations say it uses average income rather than median household income for its calculations, overstates the amount of taxes paid by households, also treats taxes paid by corporations as if they were paid by households, and fails to account for the benefits taxpayers receive from hospitals, schools and other public infrastructure.

When this data came to light, Canadian netizens exploded en masse.

“Canada-The Country of Thousands of Taxes!”

“And yet, the national debt is getting higher and higher!”

“Thank you Trudeau! I so love paying taxes to you to make Canada 'better and better'”

“It only gets better the more you pay!”

Some Canadian taxes are still going up. Middle class families pay taxes hard, but can collect far fewer benefits.

-------- END --------